Comprehensive Analysis of Digital Advertising in Bangladesh

What is Digital Marketing?

Digital marketing refers to the promotion of products or services via online channels to drive traffic, boost brand awareness, and generate leads or sales through data-driven strategies.

This market encompasses a wide range of formats, including digital video, search engine advertising, social media, digital banners, digital audio, digital classifieds, connected TV, in-app ads, and influencer advertising.

BD Market Projections and Key Figures

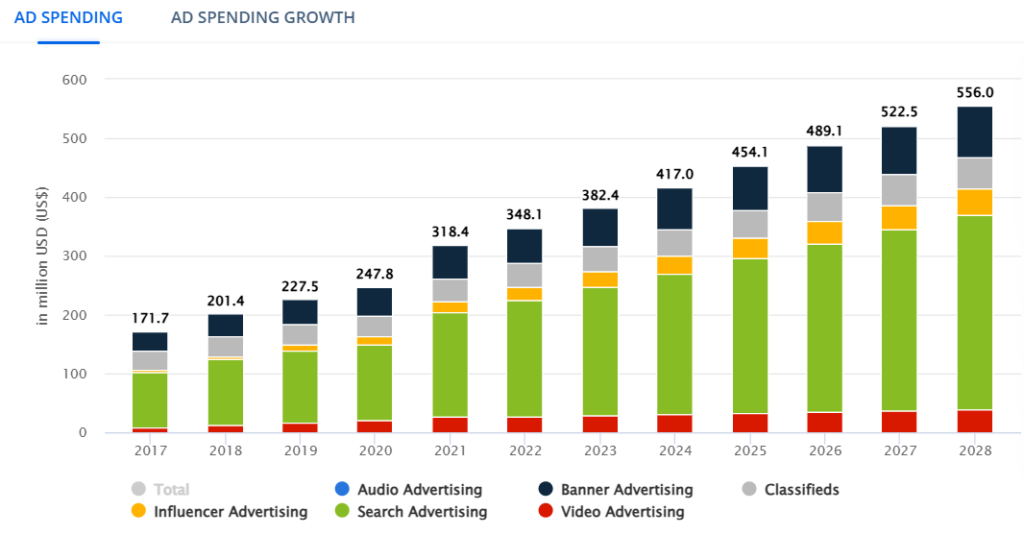

- Projected Ad Spending: In 2024, ad spending in Bangladesh’s digital advertising market is expected to reach approximately US$416.9 million.

- Leading Segment: The largest segment, Search Advertising (paid + organic), is projected to have a market volume of US$238.7 million in 2024 and at least a 10% increase in SEO agencies in Bangladesh.

- Global Context: By comparison, the United States leads globally with projected ad spending of US$298 billion in 2024.

- User Metrics: The average ad spending per user in the Search Advertising segment is forecasted to be US$8.0 in 2024.

- Mobile Shift: By 2028, mobile is projected to account for 41% of total ad spending in Bangladesh’s digital advertising market by 190.36 million mobiles users in bangladesh.

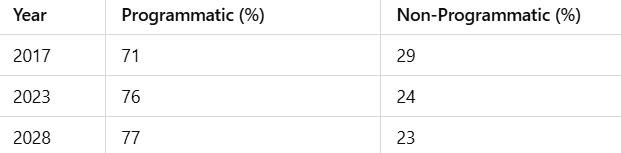

- Programmatic Dominance: Approximately 77% of the revenue in the digital advertising market is expected to come from programmatic advertising by 2028.

BD Market Structure and Key Components

The digital advertising market in Bangladesh is divided into various sub-segments:

- Audio Advertising

- Banner Advertising

- Classifieds

- Influencer Advertising

- In-App Advertising

- Search Advertising

- Social Media Advertising

- Video Advertising

Growth Trends in Ad Spending

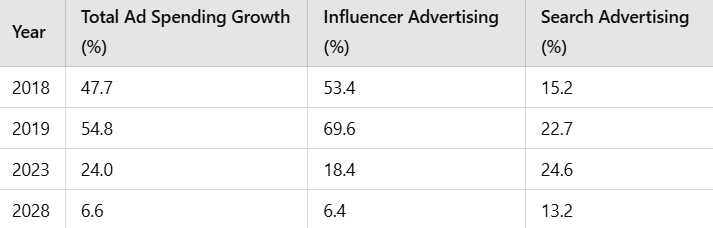

The growth trends in digital advertising have shown fluctuating patterns over the years:

- Influencer Advertising peaked in 2019 with a growth rate of 69.6% but has since seen a decline.

- Search Advertising maintained steady growth and is anticipated to continue leading the market.

- Video Advertising experienced an increase but is projected to stabilize in the coming years.

** Data converted from local currencies using average exchange rates, updated as of March 2024.

Breakdown of Ad Spending by Format

Desktop vs. Mobile Ad Spending:

- Desktop ad spending remains significant but is projected to see a consistent decline relative to mobile. By 2028, 41% of digital ad spending is expected to come from mobile devices, showcasing the continued shift towards mobile-first strategies.

Ad Spending by Industry

The FMCG sector dominates digital advertising spending, accounting for 33.8% of the market share, followed by Pharma & Healthcare (9.5%) and Telecommunications (9.0%).

Industry Breakdown (2023):

- FMCG: 33.8%

- Pharma & Healthcare: 9.5%

- Telecommunications: 9.0%

- Government: 7.5%

- Retail: 7.1%

- Business Services: 4.5%

- Financial Services: 4.0%

- Entertainment & Media: 3.3%

- Home Appliances & Furniture: 3.0%

- Other: 2.8%

Programmatic vs. Non-Programmatic Ad Spending

Programmatic advertising is projected to dominate the market, rising from 71% in 2017 to 77% by 2028.

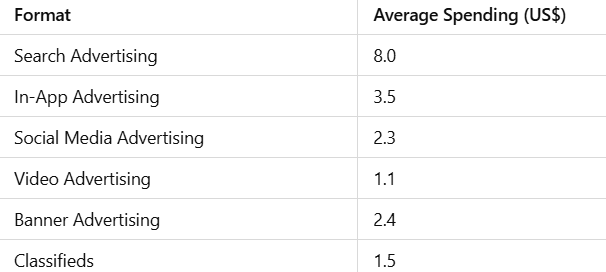

Average Ad Spending per Internet User

The average ad spending per internet user varies across advertising formats:

- Search Advertising leads with a projected average of US$8.0 per user in 2024.

- In-App Advertising and Social Media Advertising follow with US$3.5 and US$2.3, respectively.

Future Outlook

The digital advertising market in Bangladesh is poised for steady growth, driven by increasing internet penetration, the shift to mobile platforms, and the rising adoption of programmatic advertising.

Brands looking to capitalize on this market should focus on mobile-first strategies, leveraging programmatic technology, and targeting high-value industries like FMCG, healthcare, and telecommunications.

Refernces: